INDUSTRY INSIGHTS

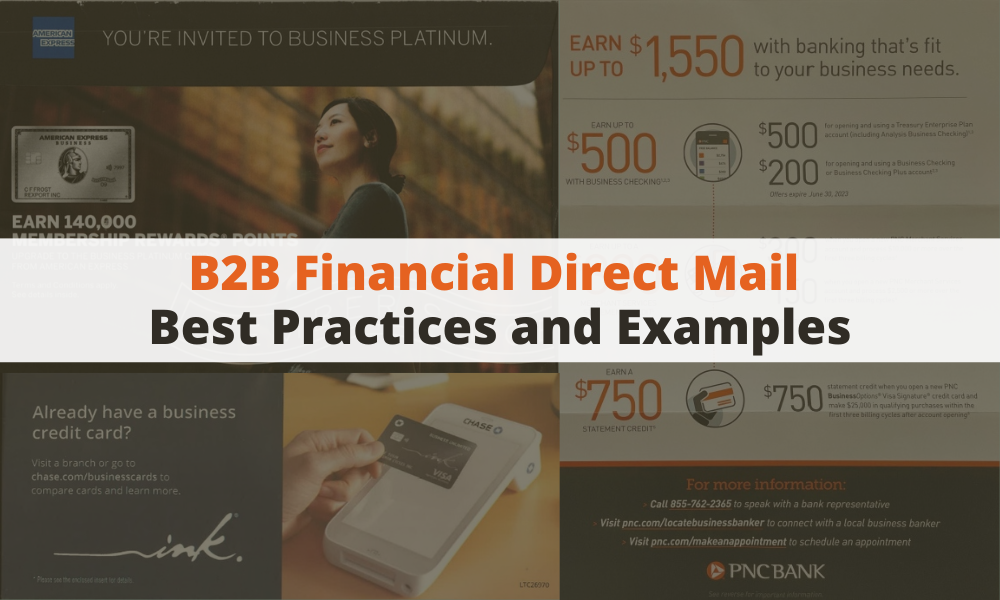

B2B Financial Direct Mail: Best Practices and Examples

Financial services marketing to B2B prospects can be a daunting task. Check out some of the best practices and direct mail examples.

Financial services marketing to B2B prospects can be a daunting task. Depending on the product or service, churn happens for several reasons cited by customers:

- bad or slow customer service

- interest rates too high or too low (depending on their preference and product)

- poor online banking experience

Given how prospective business customers get dozens of emails a day, direct mail has the ability to stand out in uncrowded postal mailboxes when it’s delivered.

What is B2B Finance Direct Mail?

B2B finance direct mail includes promotions for products and services that help businesses manage their money as well as provide protection from different types of risks.

In Who’s Mailing What!, B2B finance subcategories are:

- Banking

- Credit Cards

- Financial Services

- Insurance

What Formats Work Best for B2B Finance Direct Mail?

All the 3 main mailer formats — postcards, folded self-mailers, and envelopes — are used to market B2B finance products and services.

Banking services such as checking are mostly promoted using self-mailers or postcards; prospects are directed online or to a local office for more information and customized service.

Envelopes are ideally suited for products and services that require detailed explanation upfront, or in the case of insurance, privacy, and discretion.

Top 7 B2B Finance Direct Mail Practices

Your direct mail can stand out by reaching the right prospect at the right time with the right message, and persuading them to act. With powerful words and compelling images, your mail can help you turn a prospect into a customer, and then, to keep spending money with you.

1. Target Your Audience

Who is your target market? For a financial institution, you can offer specific products or services based on firmographic segmentation. Some business attributes are similar to those in B2C marketing, such as geographic location. Others, however, can be leveraged to zero in on prospects by company type, industry vertical, or employee headcount and/or annual revenue.

In this example, Truist’s campaign casts entrepreneurs as “the backbone of our community” and shows a busy solo operator on the front of this postcard.

2. Focus on Current Customers

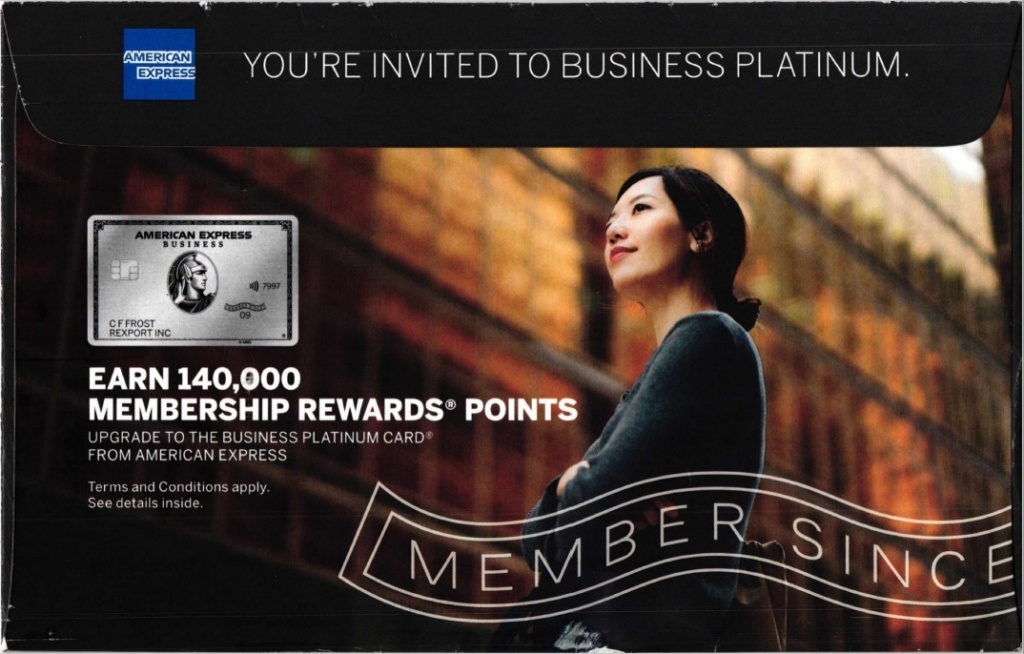

When done right, looking for ways to keep your current customers engaged and loyal (and maybe even earn more of their business) can pay dividends like increasing your ROI and sales. How? By cross-selling or upgrading them to other or additional products or services.

In this example, a “valued Business Card member” is offered an upgrade by American Express to the Business Platinum Card, which carries more rewards points and enhanced benefits.

3. Show Your Credentials

To build trust in the eyes of your business prospect, let them know how others see you. Your professional accreditations, business memberships, and social media or consumer ratings can help you establish your reputation in your B2B direct mail.

The reverse side of the letter from fintech company Fundbox showcases its Trustpilot star ratings and customer testimonials. It also builds credibility and trust by showing the logos of business software brands that integrate well with the company.

4. Appeal to Emotions

You may think of B2B marketing as cold, analytical, and fact-based. However, making an emotional connection is crucial in setting the stage for people to change their behavior. Swedish entrepreneur Axel Andersson and direct marketing agency founder Bob Hacker identified seven key emotional drivers:

- Greed

- Fear

- Guilt

- Anger

- Exclusivity

- Flattery

- Salvation

What businessperson ultimately won’t at least consider how they can earn money when it’s offered to them? It may be “greed”, but it’s easily the most common emotional driver in B2B finance direct mail — just as it is for the B2C market. And as I’ve pointed out previously, businesses are people, not buildings. So go ahead and appeal to those emotional touchpoints.

This example from PNC lists a variety of options through which a new business customer can earn cold, hard cash (greed) for their bottom line by completing certain transactions.

To get your B2B finance prospects to respond, your direct mail campaign’s copy should reflect one or more of these motivators. However, the emphasis here is placed on how the company benefits, especially for small business owners or solopreneurs.

- “[Y]ou’re invited to apply for the U.S. Bank Triple Cash Rewards Visa Business Card — a card many business owners want, but not everyone can get.” (Exclusivity — U.S. Bank)

- “With the BuyPower Business Card from Capital One, business owners like you get rewarded for their hard work” (Flattery — Capital One)

5. Talk About Benefits, Not Features

In B2C mail, you should always try to answer a key question a prospect has when seeing your mail: “What’s In It For Me?”

B2B finance mail isn’t all that different. The key here is to demonstrate value more clearly for the business, instead of the target person. Or, to put it another way, to answer “What’s In It For The Business?”

The prospect may not have time to dive into the weeds and think about how the nitty-gritty features of your product or service can help them. Instead, frame the features as answers or solutions to WIIFTB — and do it quickly and as clearly as possible.

Like most campaigns, this postcard from fleet gas supplier Fuelman focuses on money, specifically, how a prospect can take control of their finances. The bullet-pointed benefits are short and to the point.

6. Answer Common Objections

Besides asking “What’s In It For The Business?”, prospects have other questions when they spend a few seconds glancing at your mail. Common ones include:

- “Not interested”

- “We don’t need it”

- “I don’t get it”

With your teaser copy and subheads, you can overcome the barriers they may have put up against reading further or responding.

In this example, Chase allows that a prospect may already have a company business card. But is it the best one for their needs? With that seed of uncertainty planted, the panel promoting this Chase Ink Business card to go online or visit a physical location to compare their current account with what’s being offered.

7. Make It Easy to Respond

Some B2B finance products and services require a long consideration or approval process. Often, that’s simply how it works. Switching to another bank or insurance provider has to go up a chain of command, to follow carefully-planned procedures.

But some target audiences may have the authority to make a purchasing decision instantly. To make it easier for your prospective customers, give them ways to respond that are both easily found and give them options.

This campaign from Better Business Funding includes a personalized card tipped to the letter with a phone number and website to respond to the offer. Both methods are also at the bottom of the letter, as is a QR code that, when scanned, opens a site that asks for the code on the card to begin their business funding application process.

Get an Edge by Learning from B2B Finance Direct Mail in Who’s Mailing What!

Who’s Mailing What! includes both B2B and B2C mail. As of August 2023, the database includes 1,153 B2B Finance direct mail campaigns.

When a mail piece is scanned for inclusion, our algorithm assigns an appropriate tag.

Here’s how to filter your search and find mail with the B2B designation:

- After logging in to the website, click on the Search option from the Dashboard.

- On the left side of the page, you’ll see Direct Mail Filters as one of the options under Filters. Scroll down to select the Finance category box; all of the subcategories (listed above) are checked by default.

- Next, scroll down to the Business Model option.

- Checking on that box means that you can search both B2B and B2C direct mail examples as the default setting. You can exclude either option from your search by unchecking the box next to it.

Final Thoughts

The buyer’s journey in B2B finance direct mail has evolved over the last 2 decades from the old lead generation. Prospects now do their own research, usually online, through professional reviews, customer ratings, and social posts, as well as seeing where Google searches take them. This provides much more of a background to inform their decision-making when they move on to engage a sales representative or simply go ahead and sign up for a financial product or service directly.

As the examples above show, driving customers online is now a necessity, if not the only option. When planning your campaign for this audience, figure out how you can make the best use of mail to get their attention as part of an overall omnichannel strategy. When properly carried out, it can reduce overall costs while improving both your ROI and response while building long-term customer relationships and loyalty.